Wilkes County Property Appraiser

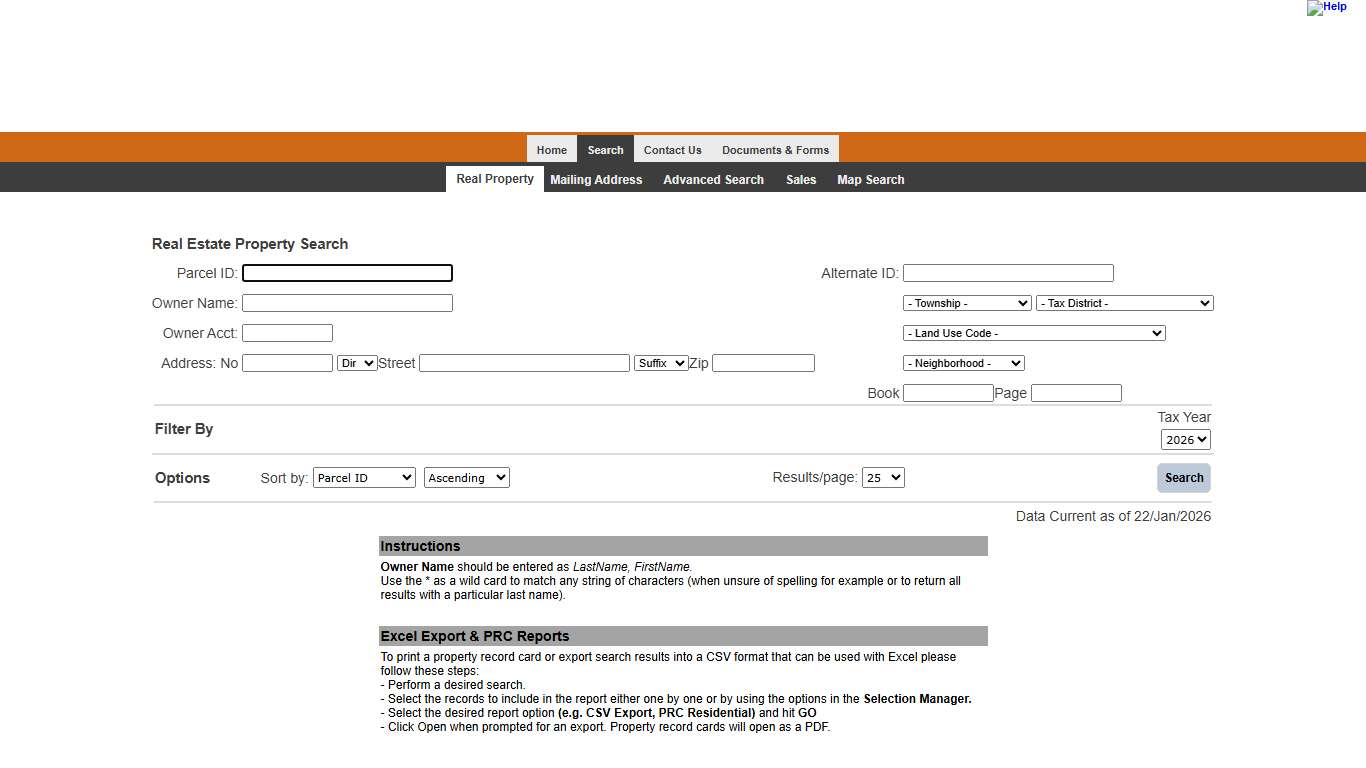

Wilkes County Tax Administration - Real Estate Property Search Search

Disclaimer The Tax Assessor makes every effort to produce the most accurate information possible. No warranties, expressed or implied are provided for the data herein, its use or interpretation. The assessment information is updated periodically and may or may not represent changes either in ownership or physical characteristics from the last certified tax roll.

https://parcelinfo.wilkescounty.net/

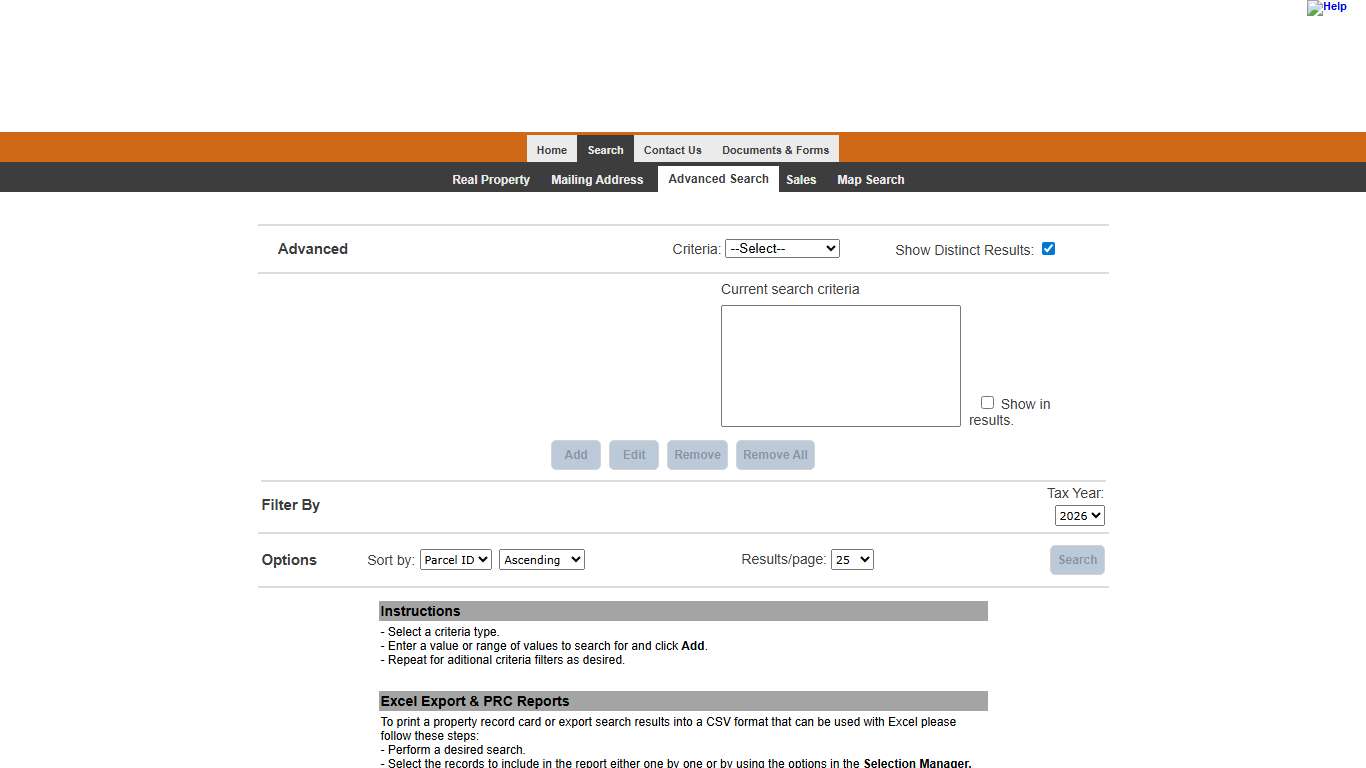

Wilkes County Tax Administration - Advanced Search

Disclaimer The Tax Assessor makes every effort to produce the most accurate information possible. No warranties, expressed or implied are provided for the data herein, its use or interpretation. The assessment information is updated periodically and may or may not represent changes either in ownership or physical characteristics from the last certified tax roll.

https://parcelinfo.wilkescounty.net/search/advancedsearch.aspx?mode=advanced

Real Estate, Personal Property, & GAP Taxes inside of Wilkesboro, NC

home > departments > finance > town tax department TOWN TAX DEPARTMENT Like any municipality, the taxes collected from property owners are integral revenue the town needs to operate, which means property owners pay town and county taxes. The tax rate for both town and county municipalities for the fiscal year is subject to change annually, as determined by each governing board during budget preparation in the spring of each...

https://www.wilkesboronc.org/real-estate-tax

Next County 2025-26 2024-25 2023-24 2022-23 2021-22 ...

2026. Ashe .4400 .4400 .4400 .5100 .5100. 2023. 2027. Avery .4000 .4000 .4000 ... NORTH CAROLINA COUNTY PROPERTY TAX RATES. FOR THE LAST FIVE YEARS. (All ...

https://www.ncdor.gov/2025-2026-county-tax-rates-finalpdf/openWilkes County, NC Property Tax Calculator 2025-2026

Calculate Your Wilkes County Property Taxes Wilkes County Tax Information How are Property Taxes Calculated in Wilkes County? Property taxes in Wilkes County, North Carolina are calculated based on your property's assessed value multiplied by the local tax rate. The county's effective tax rate of 0.69% is applied to determine your annual property tax obligation.

https://propertytaxescalculator.com/northcarolina/wilkes-county

Walker hired as Wilkes tax administrator News journalpatriot.com

The Wilkes County commissioners on Tuesday night unanimously approved hiring an Alexander County native as new Wilkes County tax administrator. He is Mark W. Walker of Hiddenite, who actually was hired as interim tax administrator because he still needs state certification as county tax assessor, which is part of the responsibility of his new position.

https://www.journalpatriot.com/news/walker-hired-as-wilkes-tax-administrator/article_2e47a8a3-e210-5e27-85e0-38c6c2d4feb5.html

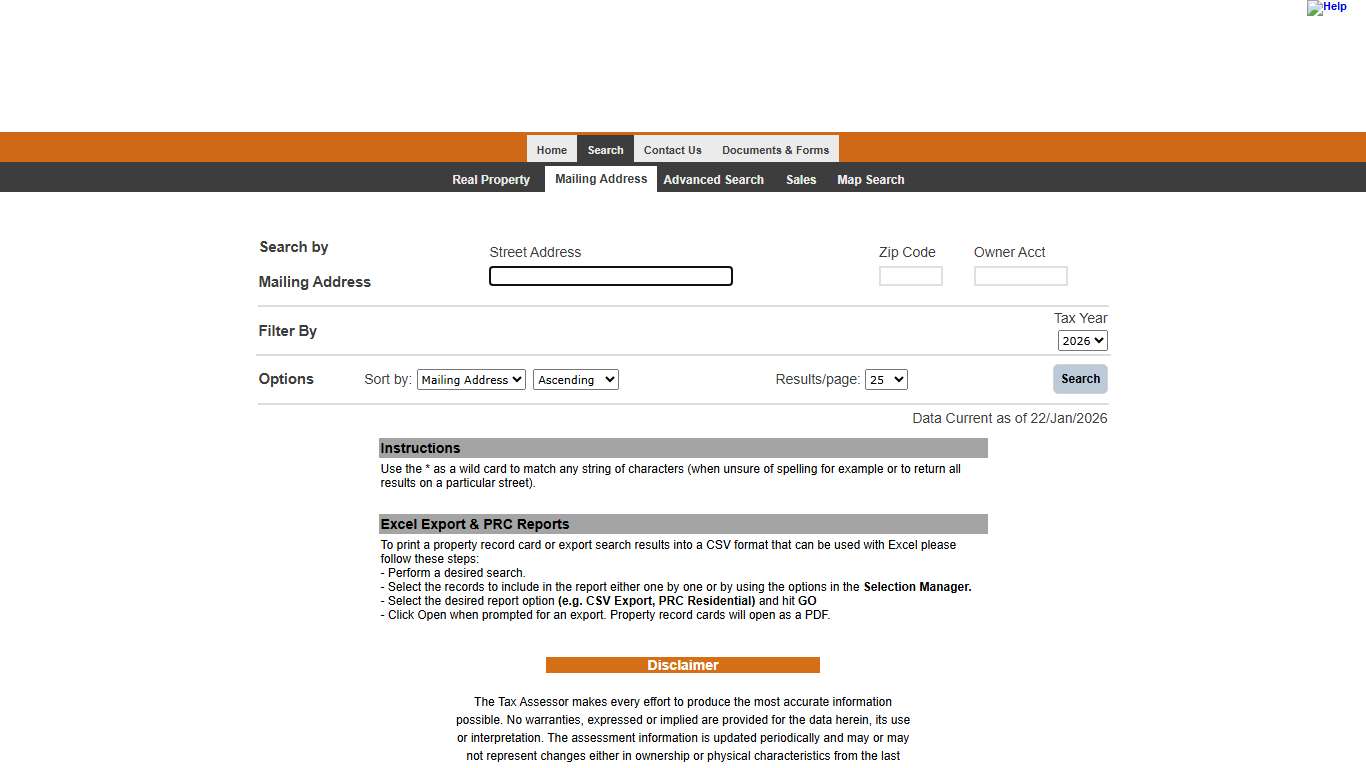

Wilkes County Tax Administration - Mailing Address Search

Disclaimer The Tax Assessor makes every effort to produce the most accurate information possible. No warranties, expressed or implied are provided for the data herein, its use or interpretation. The assessment information is updated periodically and may or may not represent changes either in ownership or physical characteristics from the last certified tax roll.

https://parcelinfo.wilkescounty.net/search/commonsearch.aspx?mode=address

Tax Administration Wilkes County, NC

Tax Administration Board of Equalization and Review The link to the Board of Equalization and Review meetings can be found here. Board of Equalization and Review Board of Equalization and Review 2026 Personal Property Listing Period Extension The 2026 Personal Property Listing Period has been extended to March 2, 2026.

https://www.wilkesnc.com/226/Tax-Administration

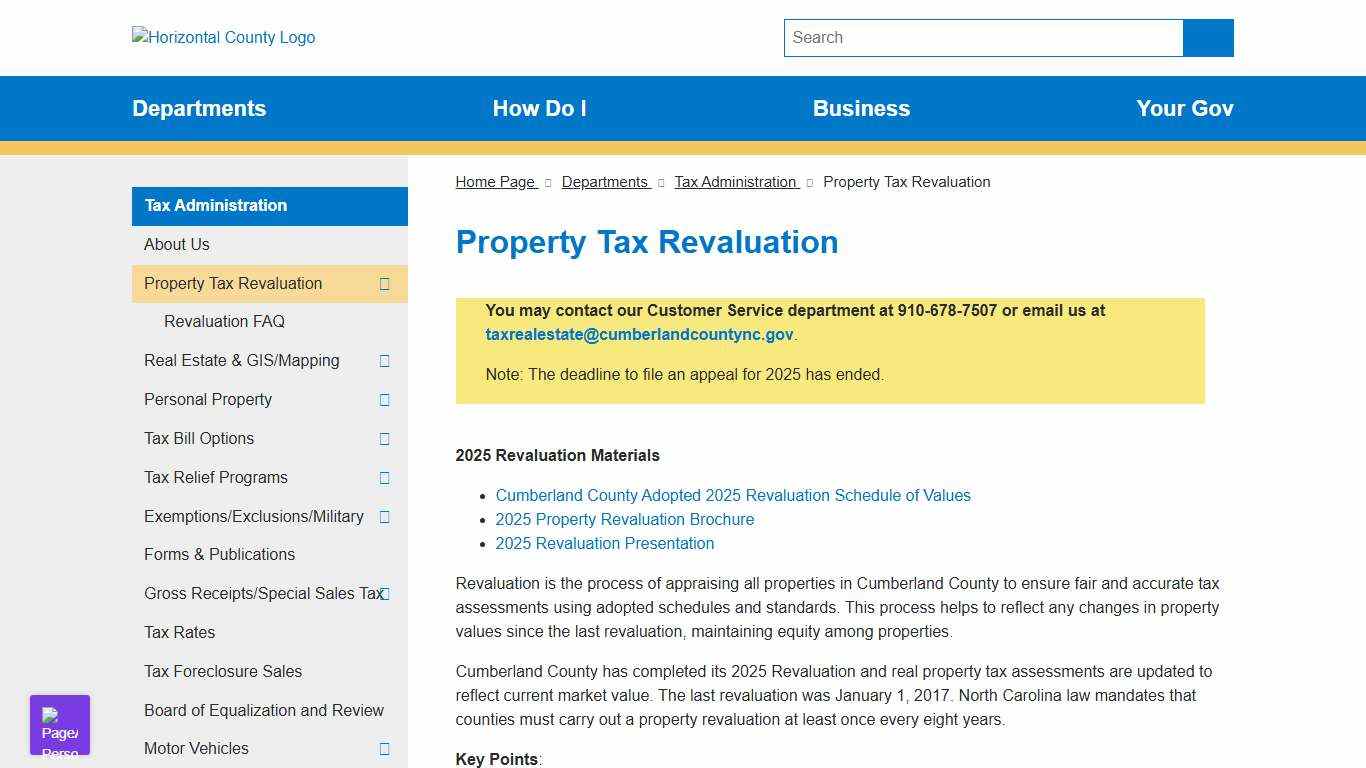

Property Tax Revaluation

2025 Revaluation Materials Revaluation is the process of appraising all properties in Cumberland County to ensure fair and accurate tax assessments using adopted schedules and standards. This process helps to reflect any changes in property values since the last revaluation, maintaining equity among properties.

https://www.cumberlandcountync.gov/departments/tax-group/tax/property-tax-revaluation

Taxpayers Reminded of 2026 Property Tax Listing Period

FAYETTEVILLE, N.C. – Cumberland County Tax Administration reminds residents and non-residents who own taxable property in Cumberland County that the 2026 property listing period is Jan. 1 - 31, 2026. Listing forms must be updated, signed and returned by Monday, Feb.

https://www.cumberlandcountync.gov/departments/tax-group/tax/2025/12/15/taxpayers-reminded-of-2026-property-tax-listing-period

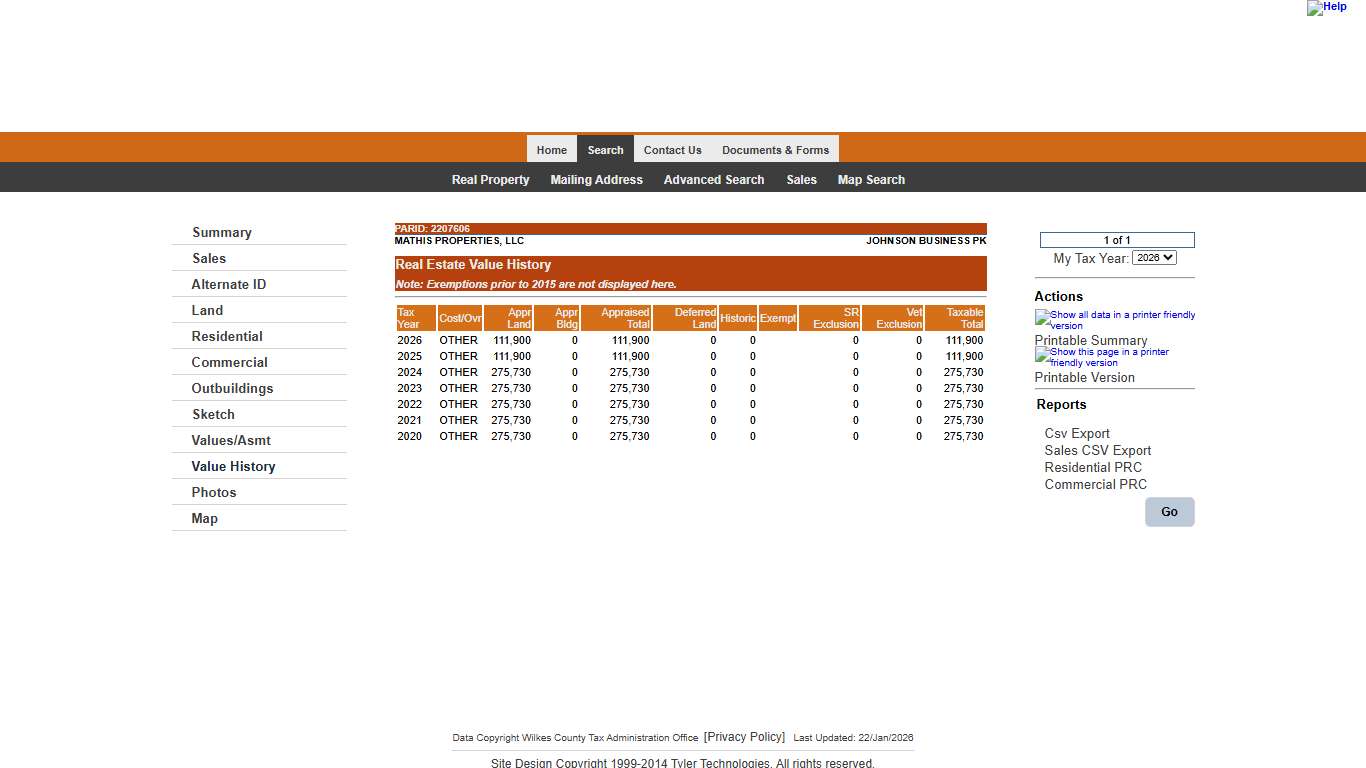

Wilkes County Tax Administration

Tax Year, Cost/Ovr, Appr Land ; 2026, OTHER, 111,900 ; 2025, OTHER, 111,900 ; 2024, OTHER, 275,730 ; 2023, OTHER, 275,730 ...

https://parcelinfo.wilkescounty.net/datalets/datalet.aspx?mode=value_history&UseSearch=no&pin=2207606&jur=097&taxyr=2026&LMparent=20

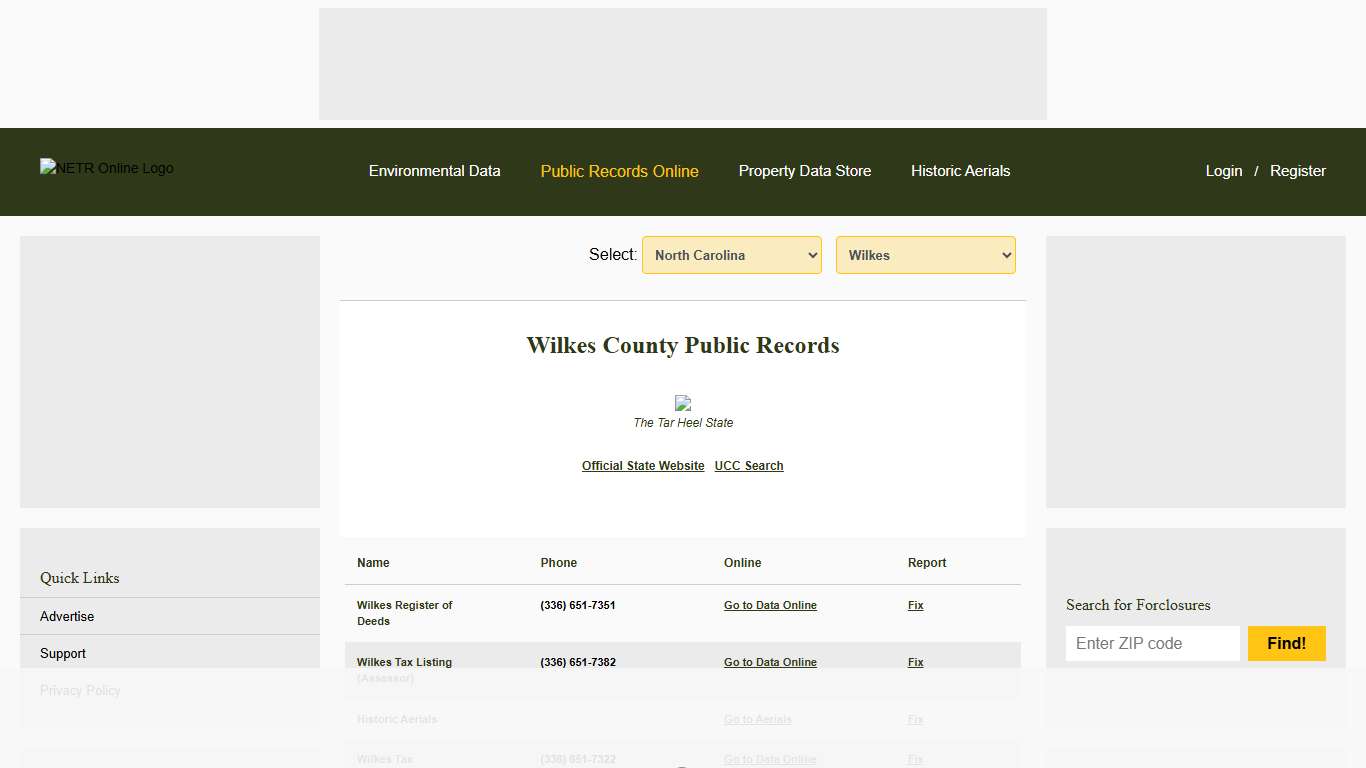

NETR Online • Wilkes • Wilkes Public Records, Search Wilkes Records, Wilkes Property Tax, North Carolina Property Search, North Carolina Assessor

Select: Wilkes County Public Records The Tar Heel State Wilkes Register of Deeds (336) 651-7351 Wilkes Tax Listing (Assessor) (336) 651-7382 Wilkes Tax Collector (336) 651-7322 Wilkes NETR Mapping and GIS Help us keep this directory a great place for public records information. Submit New Link Products available in the Property Data Store...

https://publicrecords.netronline.com/state/NC/county/wilkes

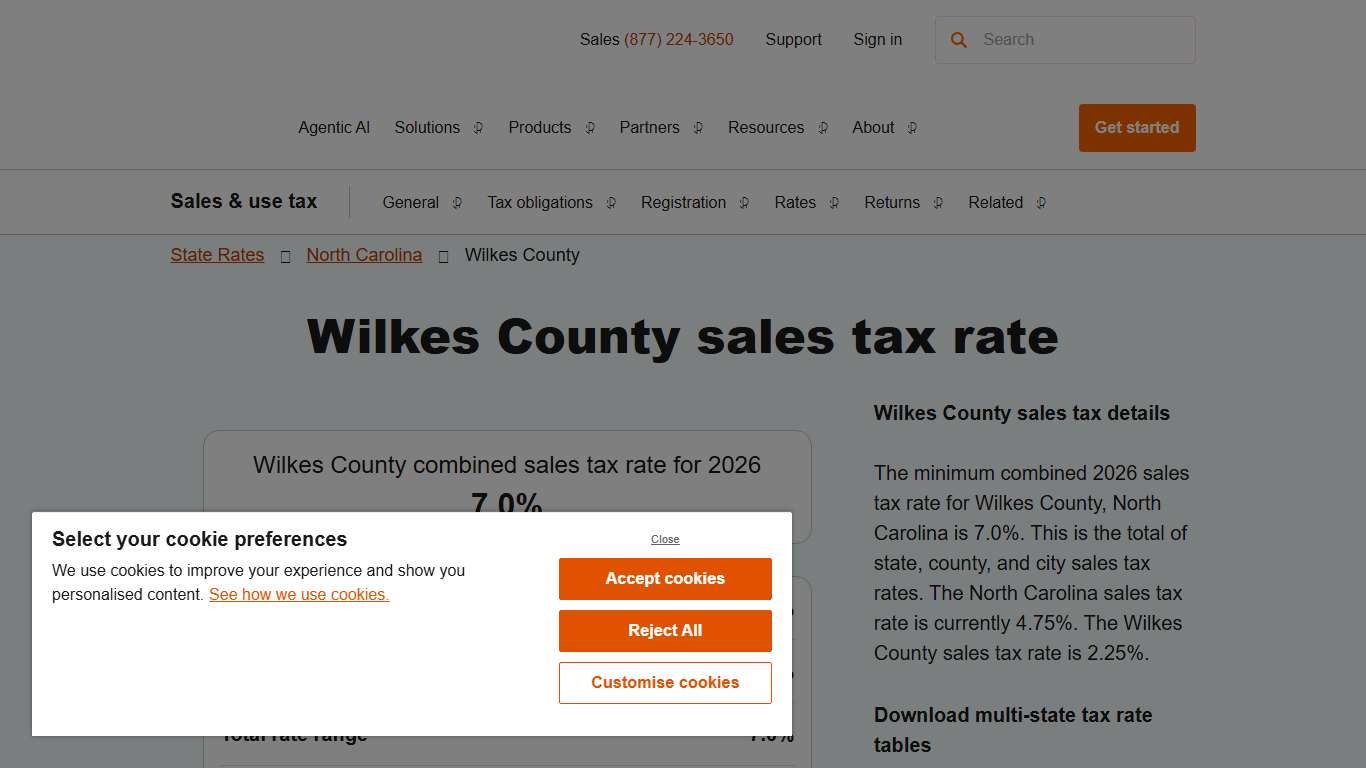

2026 Wilkes County County Sales Tax Rate - Avalara

Wilkes County sales tax details The minimum combined 2026 sales tax rate for Wilkes County, North Carolina is 7.0%. This is the total of state, county, and city sales tax rates. The North Carolina sales tax rate is currently 4.75%. The Wilkes County sales tax rate is 2.25%.

https://www.avalara.com/taxrates/en/state-rates/north-carolina/counties/wilkes-county.html